child tax credit 2021 eligibility

All tutors are evaluated by Course Hero as an expert in their subject area. To Qualify for the Senior Citizen Rent Increase Exemption SCRIE program you must.

How To File For The Advance Child Tax Credit Payments In Milwaukee

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements.

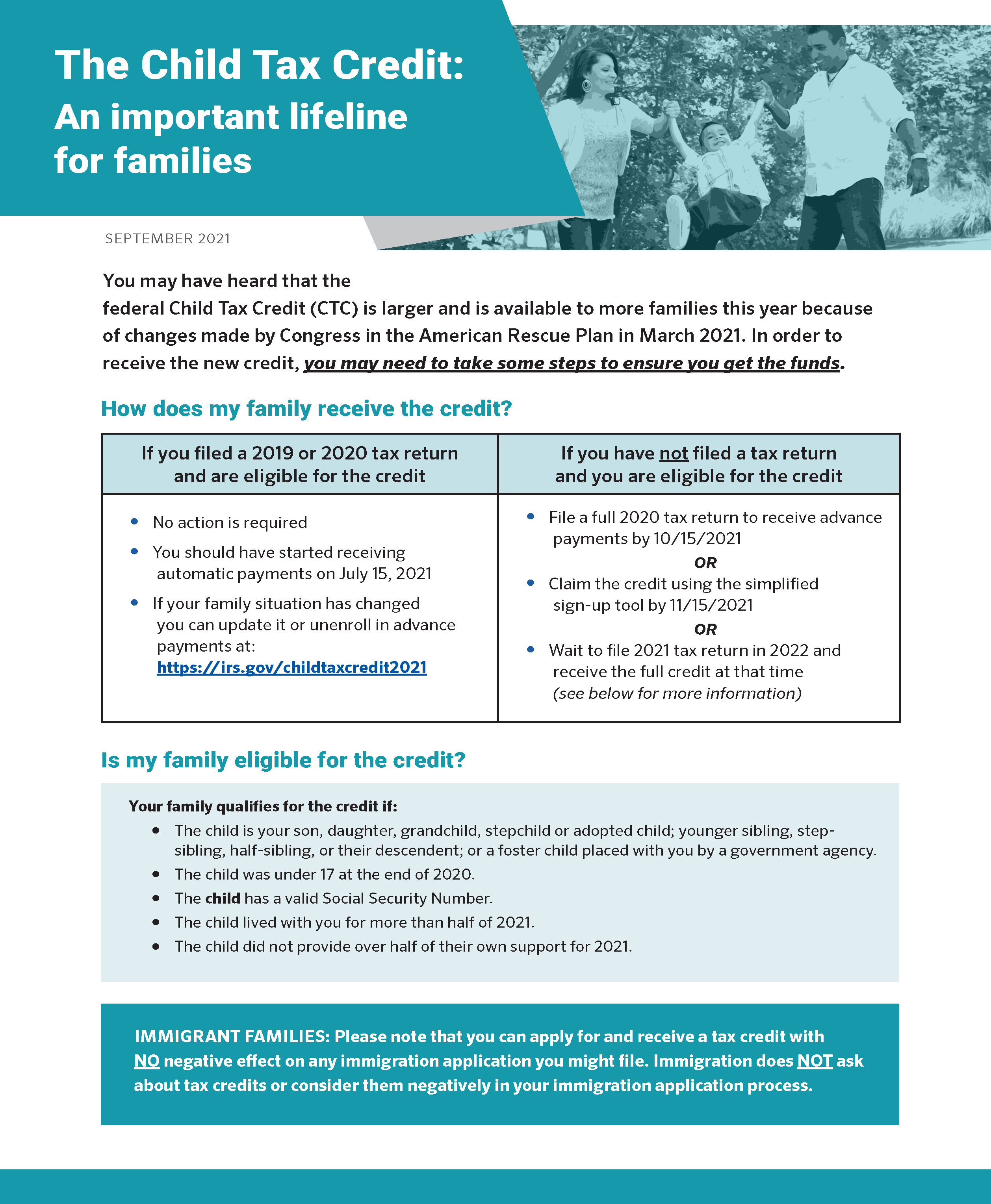

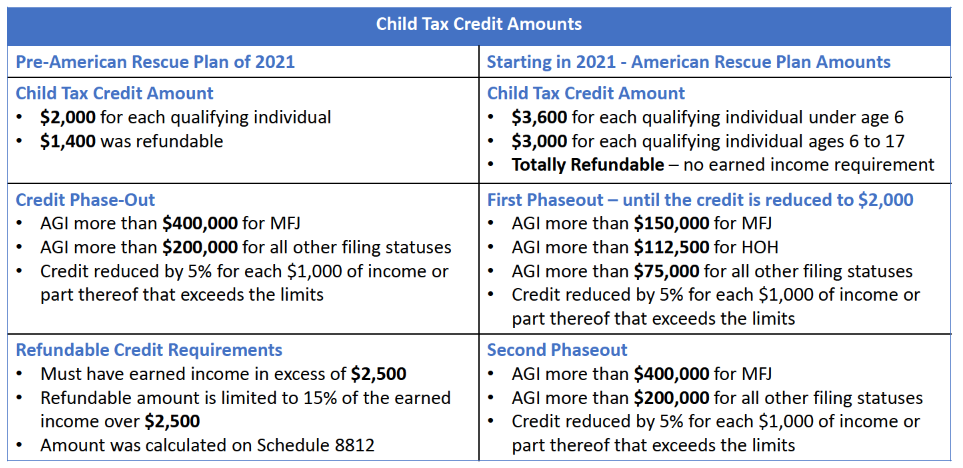

. It does not matter when during the year you. Prior to 2021 the maximum value of the Child Tax Credit was 2000 per eligible child. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

The phase-out threshold was increased from 75000 to 200000. Citizens with income below 75000 or married. Last year that maximum value increased to 3600 for children under age 6 and 3000.

The American Rescue Plan Act temporarily changed the Child and Dependent Care Tax Credit for the 2021 tax year. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The deadline for filing your ANCHOR benefit application is December 30 2022.

It increased the caps to. Be the Head of Household as the primary tenant named on the leaserent order or. Gwyneths correct and most favorable 2021 filing status is Single.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child. Caledonia golf and fish club scorecard Feb 17 2022 An individuals modified adjusted gross income AGI must be 75000 or under or. Saul is a Qualifying Child Dependent for.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. We will begin paying ANCHOR benefits in the late Spring of 2023. You are eligible for a property tax deduction or a property tax credit only if.

All children must possess a Social Security Number. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying. The remaining half of the credit for.

ANCHOR payments will be paid. If your child died on or after January 1 2021 you remain eligible to claim the 2021 Child Tax Credit for the full year and no action is required. 2021 Child Tax Credits eligibility.

Be at least 62 years old. This law made the credit refundable. Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17.

Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022. The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older. 1 day agoCongress authorized three rounds of payments that benefited an estimated 165 million eligible Americans.

Parents must have an earned income of at least 2500. 13 hours agoStimulus payments and 2021 child tax credits are still available for the nearly 10 million eligible individuals who havent received thembut the deadline is just around the.

Information On The Child Tax Credit And Eligibility Newsletter Archive Congressman Jamie Raskin

Arpa Expands Tax Credits For Families

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Fuller Advance Child Tax Credit Payments

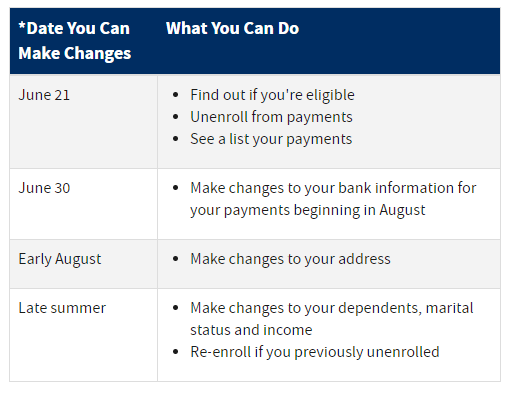

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Child Tax Credits Causing Confusion As Filing Season Begins

Child Tax Credit 2021 Changes Grass Roots Taxes

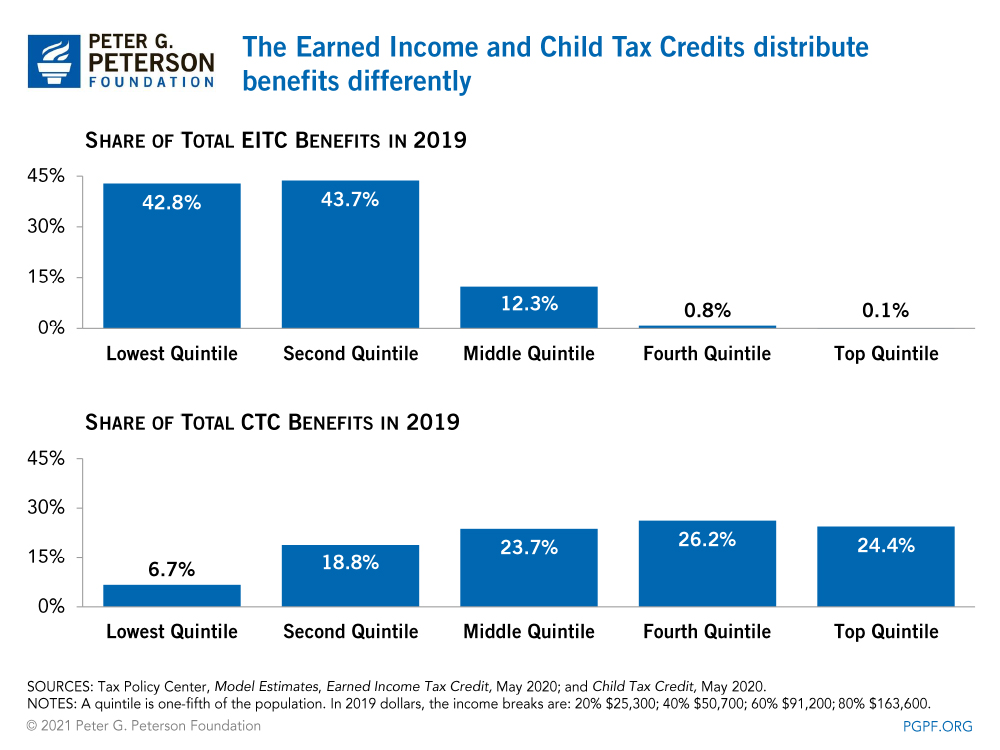

What Is The Earned Income Tax Credit Tax Policy Center

Child Tax Credit Earned Income Tax Credit

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

The Child Tax Credit An Important Lifeline For Families North Carolina Justice Center

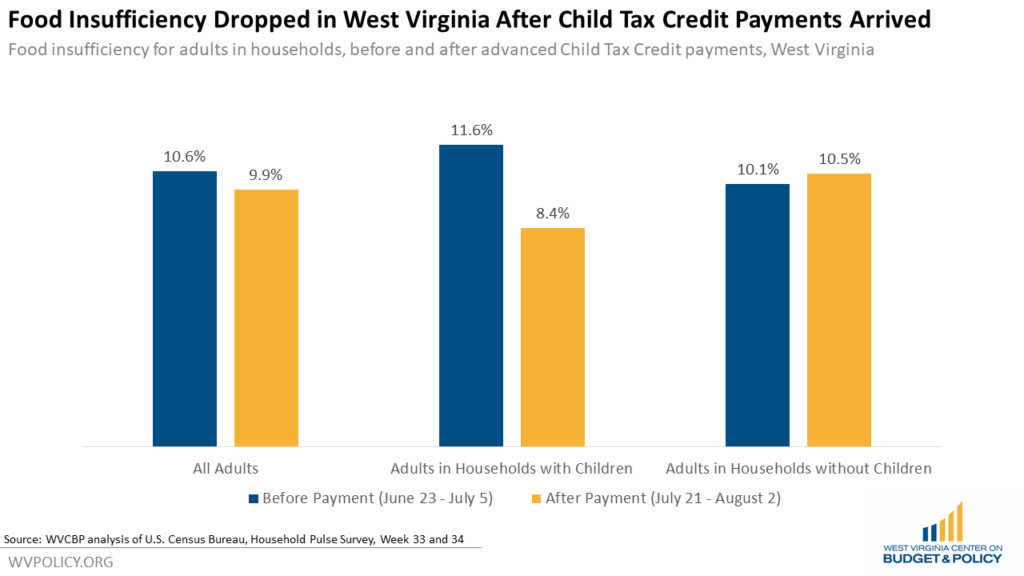

Data Already Showing Positive Impacts Of Child Tax Credit Though More Can Be Done To Ensure Benefit Reaches All Children West Virginia Center On Budget Policy

Feds Launch Website For Claiming Part 2 Of Child Tax Credit The Seattle Times

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2 Com

What You Need To Know About The Expanded Child Tax Credit For 2021

2021 Changes To Child Tax Credit Support

Child Tax Credit 2021 What To Know About Monthly Payments Money