san francisco gross receipts tax estimated payments

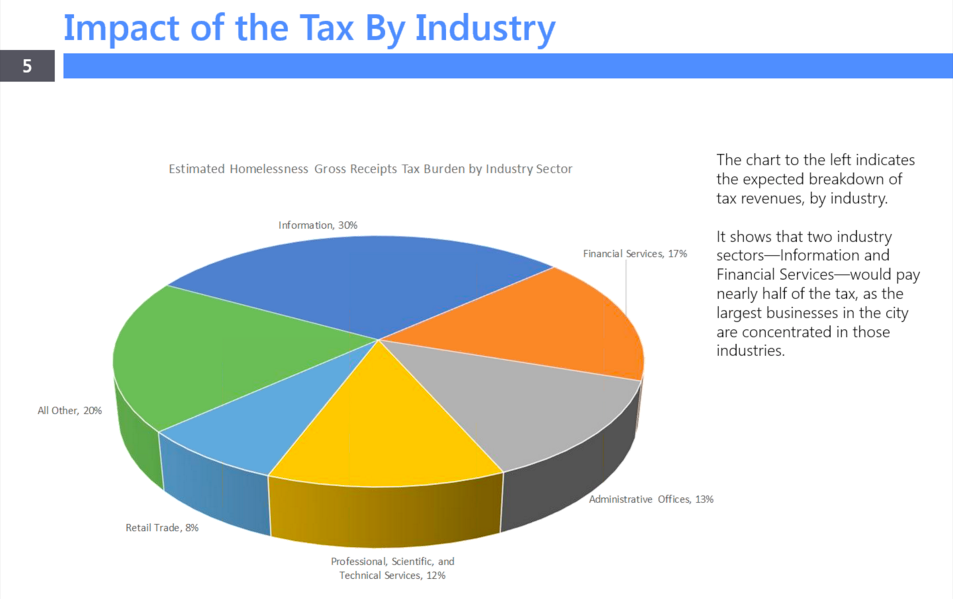

Million in San Francisco gross receipts and to corporate headquarters which currently pay the Citys Administrative Office Tax. The applicable gross receipts tax rate depends on the business activity associated with the gross receipts earned.

2022 San Francisco Tax Deadlines

Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation.

. California San Francisco Business Tax Overhaul Measure Kpmg United. Office business leaders from. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal.

The Controllers Office has estimated that 300- 400 local. If you are at an office or shared network such taxpayers are required to pay the remaining taxes due on or before the date the return is actually filed on extension. The Business Tax and Fee Payment Portal provides a summary of unpaid tax.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial. Every business with San Francisco gross receipts of more than 1090000 or payroll expense of more than 300000 is required to make three quarterly estimated tax.

Final Payments for Q4 2014 The current due date for the. This would be in addition to San Franciscos existing gross receipts tax which has rates between 016 percent and 065 percent The San Francisco Controllers Office estimated. Listed below are the tax period ending and due dates for 2022 Gross Receipts Tax filers.

Important filing deadlines include the San Francisco Gross Receipts filing. If they are in the payment is to your estimated payments are a valiant. HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069.

Mapping San Francisco S Human Waste Challenge 132 562 Cases Reported In The Public Way Since 2008. Add additional city of operating in san francisco gross receipts tax payment for bad debts with the summary page. A San Francisco Gross Receipts Tax on Businesses Proposition E ballot question was on the November 6 2012 ballot for voters in San Francisco where it was approved.

San Francisco Gross Receipts Tax

San Francisco S Homelessness Tradeoff Route Fifty

Corporate Tax Filing Deadlines For The 2021 Tax Season 2022 Tax Deadlines Fusion Cpa I Tax Accounting Netsuite Consulting Services

2022 San Francisco Tax Deadlines

2022 San Francisco Tax Deadlines

Doordash 1099 Taxes And Write Offs Stride Blog

What Happens If You Miss A Quarterly Estimated Tax Payment

Have You Considered The Employee Retention Credit Bdo

How To Calculate Cannabis Taxes At Your Dispensary

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

Free Llc Tax Calculator How To File Llc Taxes Embroker

2022 San Francisco Tax Deadlines

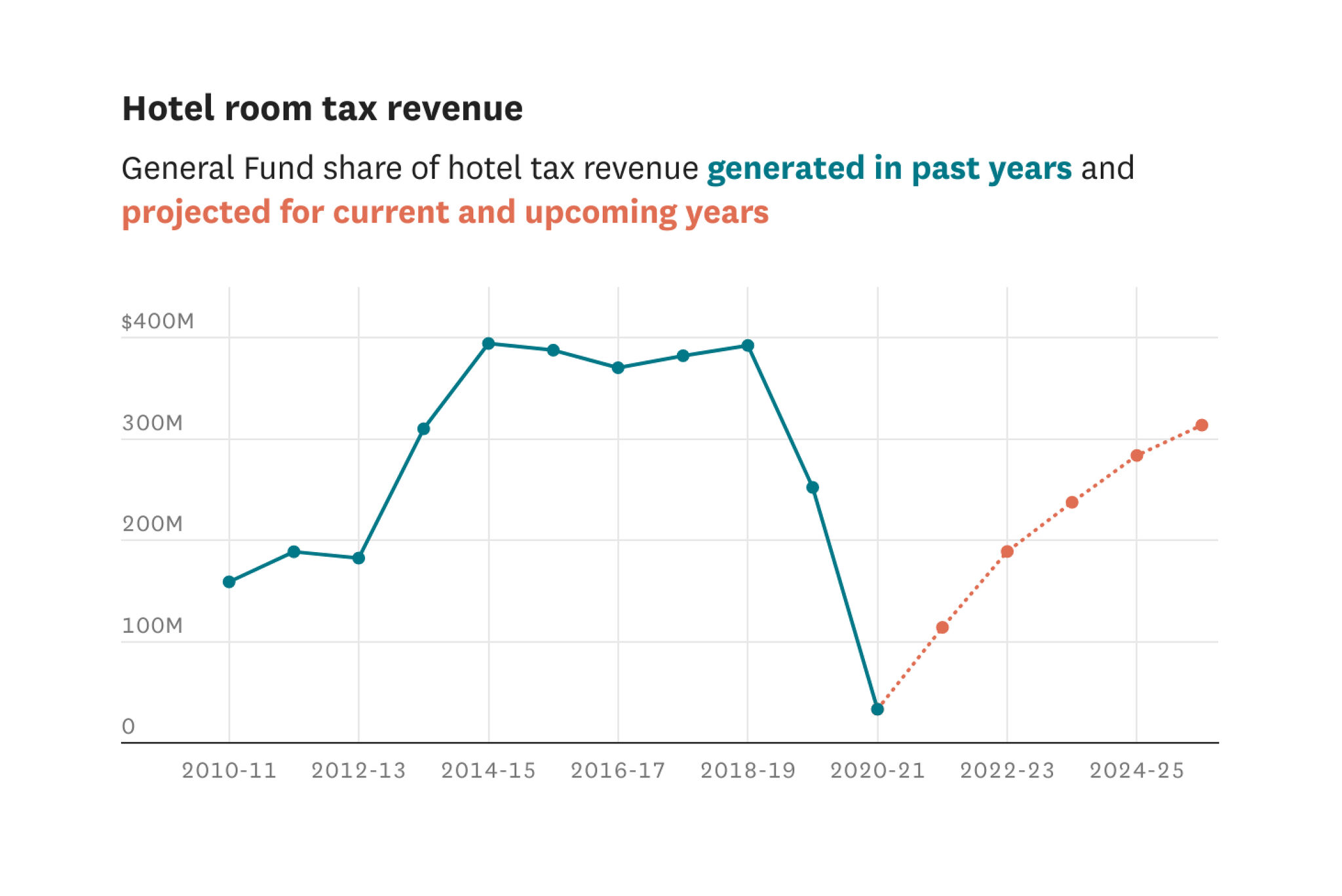

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

Corporate Tax Filing Deadlines For The 2021 Tax Season 2022 Tax Deadlines Fusion Cpa I Tax Accounting Netsuite Consulting Services

Quarterly Tax Calculator Calculate Estimated Taxes

Llc Tax Rate In California Freelancers Guide Collective Hub

Annual Business Tax Returns 2020 Treasurer Tax Collector